Life Insurance:

*Disclosure: I am not an employee at RBC. This video is not a recommendation for a specific insurance company, although RBC is a leading company, we will find the most appropriate coverage for your needs at the purchase time.

What is Life insurance?

It is a contract between an individual (policyholder) and an insurance company. The policyholder pays regular premiums, and in return, the insurer pays a death benefit to the beneficiaries upon the policyholder’s death.

Although (of course), insurance can’t bring a person back, it can make the road easier financially for those left behind.

Why should consider Life Insurance?

There are many reasons to consider life insurance:

- Financial Security: Ensures that your loved ones are financially protected in case of your untimely death.

- Debt Coverage: Helps pay off debts like mortgages, car loans, and credit cards.

- Income Replacement: Provides a source of income for your family to maintain their lifestyle.

- Future Expenses: Can be used to fund children’s education or other future financial needs.

- Estate Planning: Helps manage and distribute your estate efficiently, and pays to your designated beneficiaries.

- Pension Supplement: This can supplement your pension, providing additional financial support in retirement.

Special Considerations for Women:

- Longer Life Expectancy: Women generally live longer than men, which can mean more years in retirement and a greater need for financial security.

- Career Breaks: Women often take career breaks for caregiving, impacting their lifetime earnings and retirement savings.

- Income Disparities: Life insurance can help bridge the financial gap caused by wage disparities

Special Considerations for Business Owners:

- Business Protection: In case of a partner or a key employee’s death. It pays a tax-free one-time lump sum.

- Diversify Business Assets: It could give access to the policy cash value.

Types of Insurance:

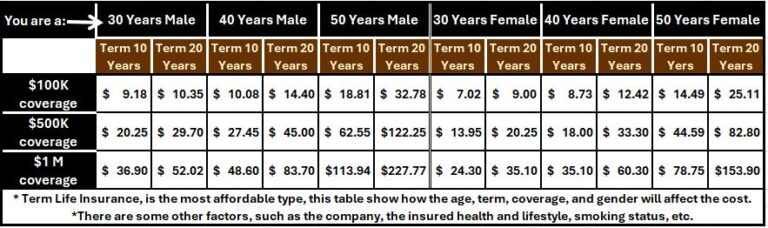

- Term Life Insurance: Provides coverage for a specific period of years(e.g.,1,5, 10, 20, X

years, to age 65). It’s generally the most affordable option. - Permanent Coverage:

- Term 100: the policyholder will continue to pay, up to the insured age of 100, and then stop paying, but the coverage will remain in force.

- Whole Life Insurance: Offers lifetime coverage with a savings component that builds cash value over time, it could be participating or non-participating.

Universal Life Insurance: Combines lifetime coverage with investment options, allowing policyholders to adjust premiums and death benefits.

Types of InsurancePolicies:

- Regular Insurance: Requires a medical exam and detailed lifestyle and health info for the insured and his/her immediate family members.

- Simplified Issue Insurance: No medical exam is required, but, there will be health questions.

- Guaranteed Issue: No medical exam, The coverage will be determined according to the insured answers, it has a higher premium, lower, and non-immediate coverage.

Some of the Insurance Companies we sell their policies:

- Assumption.

- Beneva Insurance.

- Blue Cross.

- BMO Insurance.

- Foresters.

- Canada Life.

- Co-Operator.

- CPP.

- Desjardins.

- Empire.

- Equitable.

- Humania.

- Industrial Alliance.

- IVARI.

- Manulife.

- RBC Insurance.

- Serenia Insurance.

- Sun Life.

- UV Insurance.

- Wawanesa.

Advantage of working with a broker:

As a broker:

- I am working on behalf of my clients, and I can offer products and policies from multiple regulated Canadian companies.

- This gives me access to a wide range of products, from many carriers.

- Accordingly, I have the flexibility, to find the option that fits my client’s needs, conditions, affordability, and eligibility, such as previous, declined, health issues, etc.